By UnionBank Human Resources Group

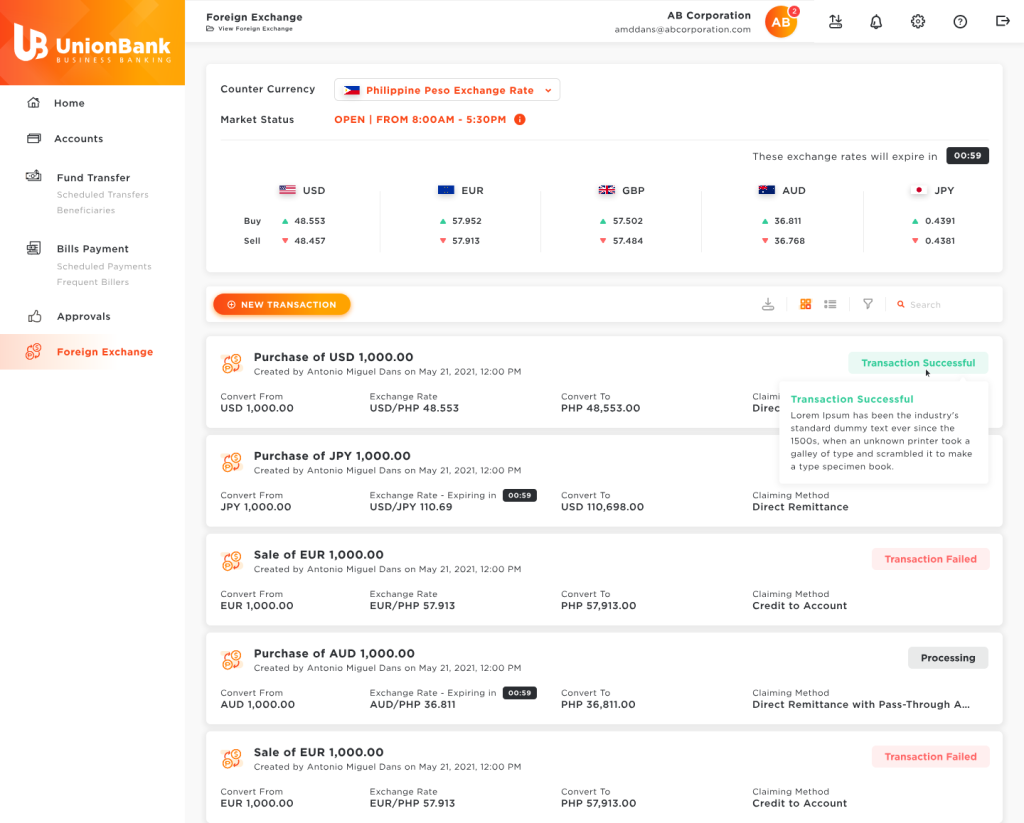

Foreign exchange and remittance processes in the Philippines have long been burdened by manual workflows, physical documentation, and branch-dependent transactions—resulting in delays, inefficiencies, and limited accessibility for corporate and SME clients. Recognizing the need to modernize and simplify these processes, UnionBank set out to build the country’s first fully digital, end-to-end FX and remittance platform for businesses.

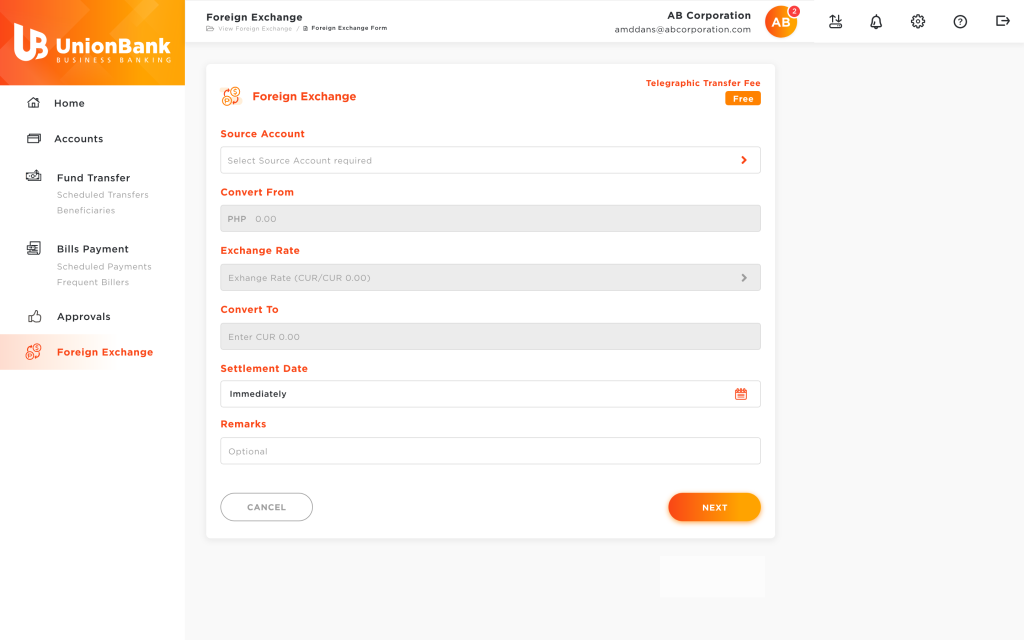

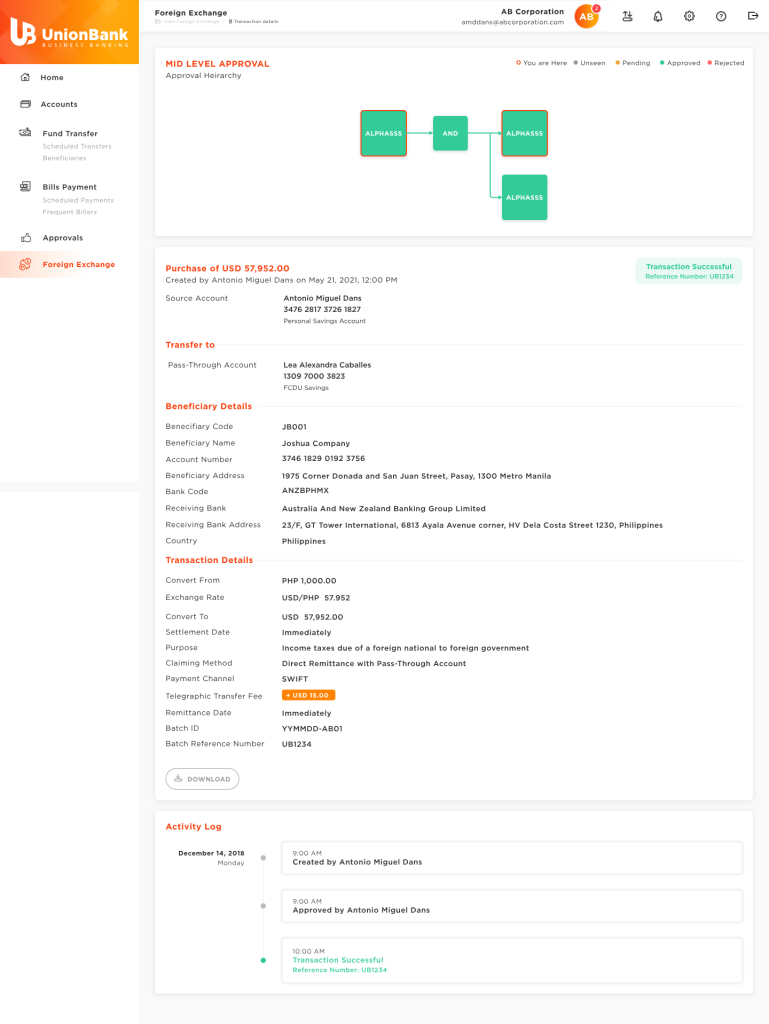

The team reimagined the FX experience by eliminating redundant steps such as signatures and physical documentation, and replacing fragmented legacy workflows with a straight-through, document-free process. Through agile development and continuous feedback integration, the platform was designed to be scalable, secure, and client-centric—offering 24/7 access to real-time FX rates and seamless transaction fulfillment. Business, product, and tech teams worked in close collaboration to ensure compliance, risk control, and operational reliability.

The transformation delivered a breakthrough in speed and efficiency. Processing time was reduced by 90%, enabling FX transactions to be completed in minutes instead of days. Within the first year, the platform generated ₱7 billion in throughput, ₱40 million in new revenue, and ₱340 million in new-to-bank business, attracting high-value corporate clients. Clients now enjoy up to 80% faster access to funds, while internal teams benefit from streamlined workflows and reduced manual effort. The initiative set a new benchmark for digital FX in the Philippines, reinforcing UnionBank’s position as a NextGen bank that empowers businesses through high-tech, high-touch operations and high-performing talent.

This is UnionBank reimagining banking to uplift lives—delivering smarter, faster, and more secure financial solutions that help clients move with agility and confidence in a digital world – a nod to the Aboitiz Great Transformation initiative.