The New Year is often regarded as an opportunity for reflection and renewed hope. While not free of the mistakes and regrets of the past, it offers a chance to recalibrate, start on the right foot, and grab hold of the opportunities dealt by fate.

Southeast Asia is a part of the world that holds a lot of promise. Its economy grew by 30% since 2015 and living standards only continue to rise. In fact, the International Energy Agency (IEA) said electricity demand in the region grew by almost double the global average in 2024 at 7%, reflecting the pace of economic activity.

Even amidst geopolitical tensions and trade headwinds, Southeast Asia is expected to further increase its share to a quarter of energy demand growth over the next decade — second only to India — due to increasing population, urbanization, need for cooling, industrialization, and wealth.

For the region’s potential to materialize, and for Southeast Asians to further improve their lot, among many other prerequisites, energy demand must be met consistently and reliably in the most affordable and sustainable way possible. Suffice to say, the balancing is easier said than done.

Today, Southeast Asia is still very reliant on fossil fuels for power, with about 80% of its energy demand being met by coal and gas in the last 15 years. Nonetheless, the idea of diversifying its energy supply has become very popular, driven by the notion that it is beneficial to tap into domestic sources of renewable energy and reduce exposure to fossil fuel imports. The IEA said that there is an estimated 20,000,000 megawatts (MW) of untapped solar and wind potential in Southeast Asia, which is “roughly 55 times the region’s current total generation capacity.”

In the Philippines, power demand in 2024 was met by contributions from coal (62.5%), natural gas (14.2%), hydro (8.6%), geothermal (8.5%), solar (3%), oil (1.1%), biomass (1.1%), and wind (1%). While gross power generation from renewables accounted for just 22.2%, programs like the Green Energy Auction (GEA) are increasing that share to 35% by 2030 and 50% by 2040, leaning heavily on more solar and wind projects as demand continues to expand.

The Philippine Department of Energy said the total capacity of solar power could hit 10,000 MW in 2026, considering 5,600 MW of committed projects and 1,600 MW more contracted under the GEA. Supporting energy transition goals, AboitizPower participates at the industrial level through Aboitiz Renewables — which just completed its sixth solar power facility late last year in San Manuel, Pangasinan — as well as in behind-the-meter executions via rooftop or ground-mounted systems through Aboitiz Power Distributed Renewables and joint venture Aboitiz Upgrade Solar.

At the same time, wind has great promise in the Philippines, especially offshore, which is estimated at over 178 gigawatts of potential capacity, according to a study by the World Bank.

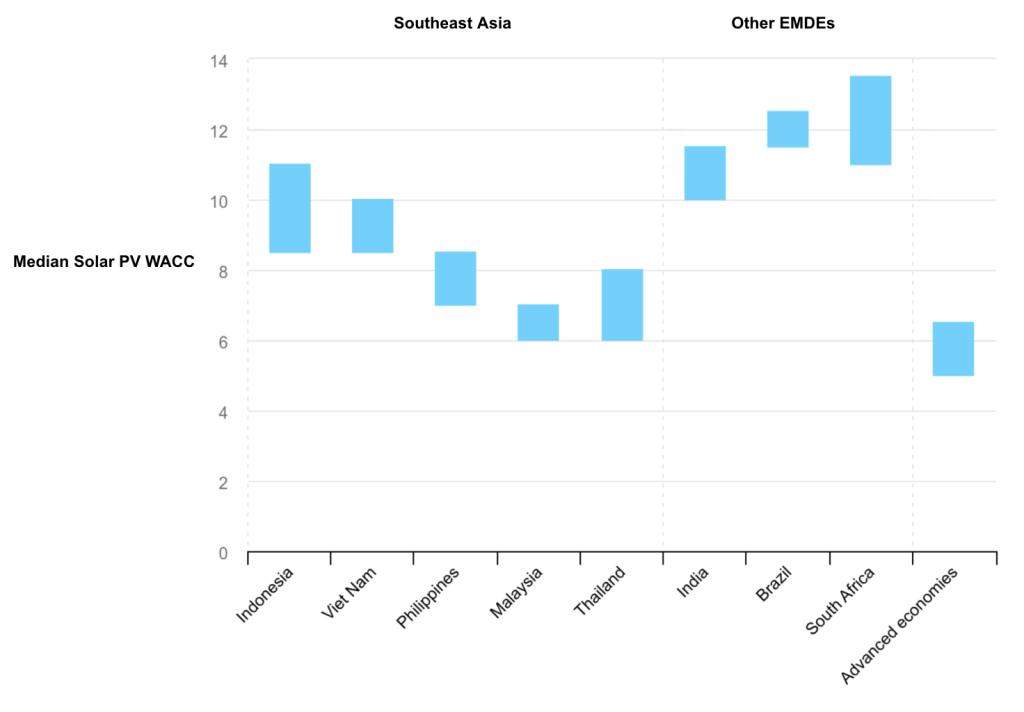

But balancing optimism with some pragmatism, one must also consider the challenges in Southeast Asia. Considering the political and regulatory risks, the IEA noted that the median weighted average cost of capital for solar in Southeast Asia and other emerging markets was higher compared to its cost of capital in advanced economies.

For Indonesia, Vietnam, and the Philippines, the cost of capital for offshore wind and battery energy storage systems was even higher than for solar PV. An Asian Development Bank study showed fixed-bottom offshore wind in the Philippines’ Luzon grid possibly having tariffs of P12-15/kWh, higher than the P3.98/kWh in the country’s electricity spot market in November 2025.

In other words, the cost to develop renewable energy is higher even as access to reliable and affordable energy remains critical to developing countries.

For the Philippines, the International Monetary Fund projected that it would take P7.39-10.67 trillion in public and private investment to realize energy transition targets between 2029 and 2050, largely depending on how much offshore wind and nuclear power will be taken up. Progress would also depend on addressing structural constraints, including road construction, grid network expansion and modernization, and, specific to offshore wind, ports and underwater power transmission, which are costly and difficult to execute.

Beyond Southeast Asia, grid investments are also struggling to match investments in new generation capacities, with some $400 billion being spent on grids, whereas there is a trillion dollars on generation assets, as per the IEA.

The prospect of more development and human prosperity, enabled by growing access to energy and solutions to bring about sufficient and affordable electricity, should drive some optimism here in Southeast Asia. But being aware of the many challenges and nuances, particularly concerning timing and cost — or at what pace Filipinos and their regional neighbors can reap the benefits of energy more affordably — should inspire some pragmatism as well.

This article is authored by Suiee Suarez, the Vice President for Corporate Affairs at AboitizPower.