By Bianca Gempesaw

Imagine cutting hours of tedious data work down to minutes—that’s the reality the TACS Team at AEV is building. With a focus on global tax compliance readiness, they’re not just streamlining processes but redefining transparency and efficiency. For them, automation isn’t just a tool—it’s the engine of agility. But transformation goes beyond speed; it’s driven by bold thinking, continuous learning, and innovation. Operating across 12 jurisdictions, the team is proving that adaptability, efficiency, and teamwork go hand in hand in tackling the complexities of tax compliance.

The Challenge: Breaking Free from Manual Workflows

Led by First Vice President for TACS Joseph Tugonon, the team serves as the tax compliance backbone of the whole Aboitiz Group. Their work involved manual processes that made maintaining global standards both time-consuming and challenging.

Their mission was clear: reduce time spent on repetitive tasks, improve efficiency, and standardize operations. But with the intricate matters and jurisdiction-specific requirements – such as compliance to Organisation for Economic Cooperation and Development Rules amongst others – finding a solution was no small feat.

The Answer: How TACS is driving Digital Transformation, Continuous Learning

To tackle these challenges, Assistant Vice President for Tax Business Solutions and External Relations Joanna “Yanyan” Abay spearheaded the adoption of tech platforms like Workiva to redefine tax workflows. By embracing automation, the team has achieved faster, more accurate outputs while significantly reducing manual effort.

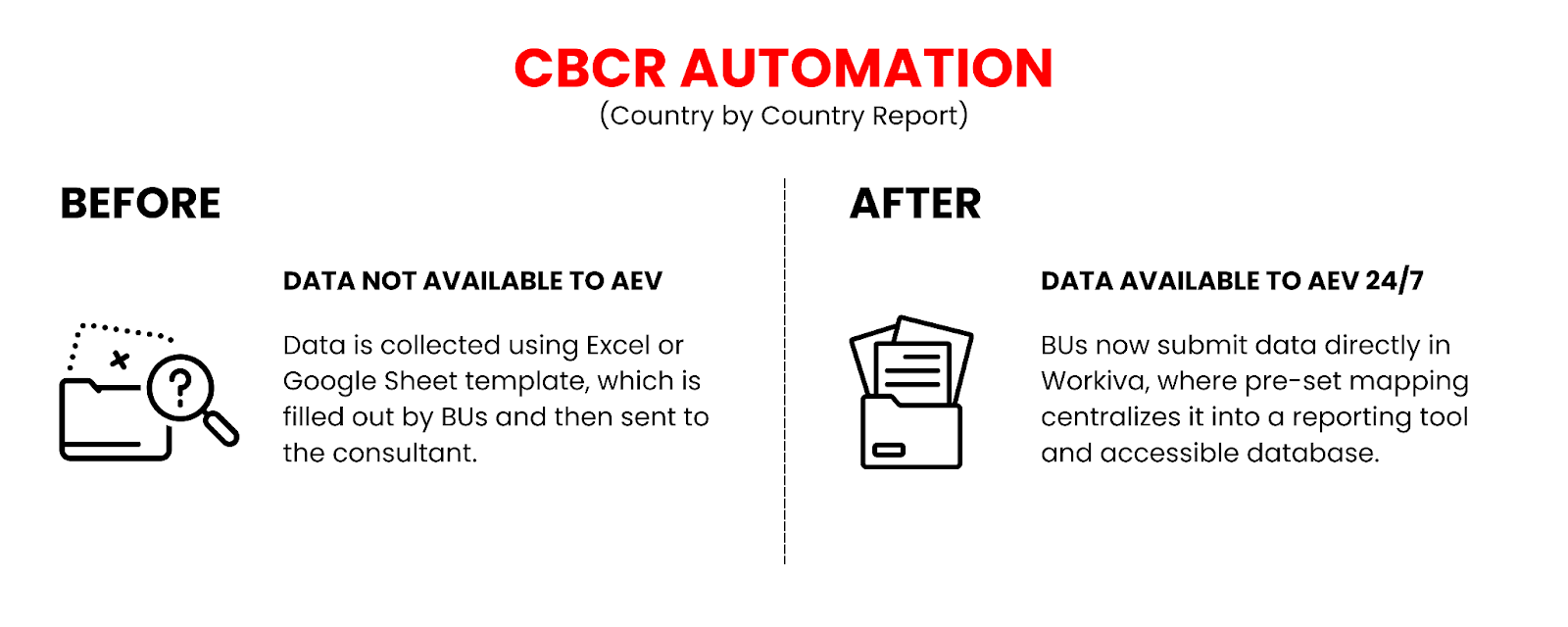

For instance, managing global financial reports was once a tedious process—teams manually consolidated data from multiple business units, coordinated across departments, and navigated unstructured information. TACS sought a solution to eliminate these inefficiencies and found it in Workiva.

In collaboration with their consultant, TACS developed an automated reporting solution leveraging data mapping and the use of a unified template that ensures data consistency and provides real-time access, streamlining workflows like never before.

Meanwhile, a strong foundation of tax knowledge is essential in navigating complex regulatory landscapes. Through continuous learning initiatives, such as training programs, cross-functional collaboration, and industry benchmarking, the team strengthens its expertise in evolving tax rules and standards. This proactive approach ensures that regulatory changes are met with confidence and agility, fostering a culture of continuous learning and compliance excellence.

When a business unit flagged a burning tax issue, the TACS Team’s expertise was put to the test. With their agile response, deep tax knowledge, and solid network, TACS swiftly resolved the concern—reinforcing financial safeguards and providing tactical treatment plans to mitigate or prevent anticipated future risks. These moments highlight their proactive approach to stakeholder management and commitment to operational resilience.

Through automation and continuous learning, the team has streamlined tax audits and compliance monitoring, boosting efficiency and ensuring the Aboitiz Group remains agile amid evolving regulations.

Sustaining Change: Building a Winning Culture, New Initiatives

Beyond technology, this transformation required a cultural shift. Yanyan emphasized the importance of breaking silos and fostering collaboration across teams.

“You can’t do it on your own,” Yanyan noted. “Walls need to break down to foster synergy and collaboration. Shared goals and collective expertise drive meaningful change in our work.”

The team also benchmarked against other companies, finding that many are heavily reliant on manual data capture. Their decision to pioneer automation like the CBCR generation reflects their drive to set new industry standards.

At the core of their approach is a simple but powerful belief: every task, no matter how small, is worth improving.

“Daily tasks may seem simple; focus on their broader impact. Focus on doing them right, not just fast. Prioritize accuracy and avoid compromising quality for speed,” Tax Business Solutions and Compliance Officer Meccah Jane Santiago emphasized.

Beyond immediate benefits, the TACS Team has fostered a culture of improvement, equipping other business units with digital tools and frameworks that scale across the conglomerate. To extend their impact, the TACS Team is rolling out new initiatives this GT2025, including:

✅ An improved self-assessment report for audit readiness program

✅ An automated reporting tool for global tax compliance (e.g. BEPS Pilar 2) that processes complex data in minutes

✅Tax refund tracker to ensure recoverability

Vision for the Future

For the TACS Team, transformation isn’t a one-time effort—it’s a team mindset. By continuously leveraging technology, learning from best practices, and embracing change, they are proving that teamwork and resilience remains the ultimate competitive advantage, both because it is so powerful and rare.

“Staying ahead isn’t just a goal, it’s a necessity. By transforming manual processes into automated solutions, the TACS Team has not only undergone a positive paradigm shift but also contributed in strengthening the organization’s agility, accuracy, and global readiness,” said Joseph.

The TACS Team’s journey proves that innovation and resilience go hand in hand. Now it’s your turn—how will you break barriers and drive transformation?